Vietnam real estate 2024: a year in review

As positive signals become more evident, now is the time to restart capital flows into real estate transactions in Vietnam and embrace the new growth cycle, write Avison Young Vietnam analysts.

Globally, 2024 marks a year of significant changes: over 50 countries held elections, Fed cut rates, and Donald Trump won the presidency the second time.

In Vietnam, August 1 became a landmark date as three real estate-related laws took effect, four months earlier than planned. While market activity seemed sluggish, the underway shifts in macro-economy and geo-politics would have a profound impact on the real estate market in the coming time.

Below are five key trends shaping the Vietnam’s real estate market in 2024.

Residential segment on recovery track amid supply imbalances

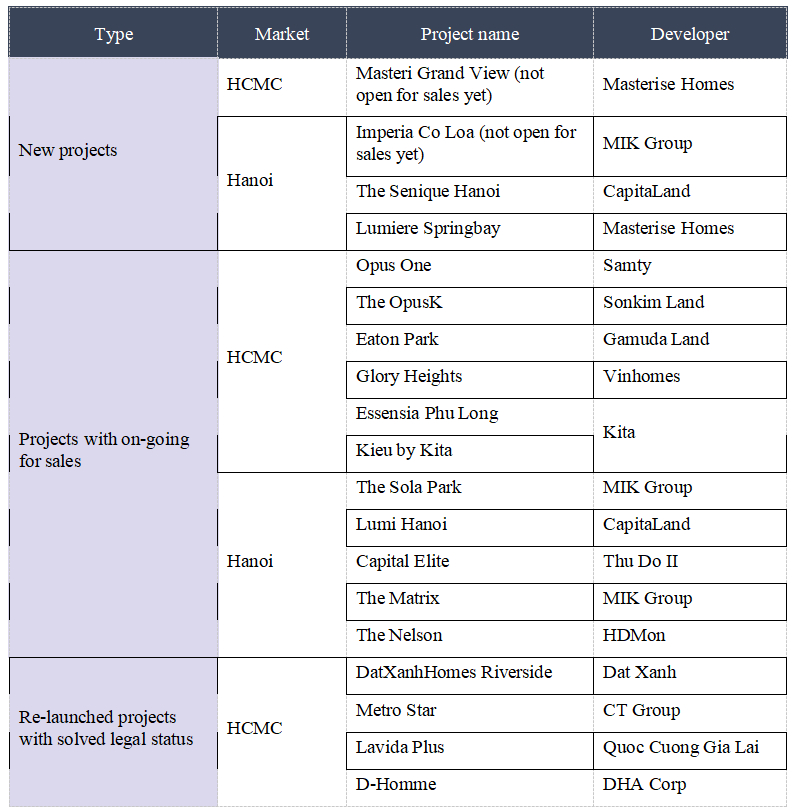

In 2024, the housing market performed better than last year, driven by new apartment supply in the second half of the year, mainly high-end properties.

In Ho Chi Minh City, most new developments were from high-end segment onwards, prices reached VND72-142 million ($2,830-5,590) per square meters. Property prices of re-launched projects also went up.

In Hanoi, housing prices surged in early 2024 and continued rising throughout the year. Units priced at VND70 million/sqm became more common in Q3, and primary prices rose by 2-4% quarter-on-quarter in Q4.

Supply in the mid-range segment continued to be limited in both HCMC and Hanoi. Apartments at affordable prices of below VND38 million ($1,500)/sqm nearly disappeared.

As prices kept going up, the housing market moved further away from intrinsic value and posed liquidity risks. The gap between market offerings and homebuyers’ needs and affordability was widening.

Meanwhile, obstacles remained in developing reasonable-priced housing. Policies and credit incentives for social housing were insufficient, while investment, leasing and purchasing processes remained complex.

Yet, there are opportunities for a more balanced market. Building more budget-friendly commercial projects and social housing in suburban or new urban areas with ample undeveloped land banks and lower development costs offers a solution to sustainable growth. Following this trend, some affordable projects have been launched recently in HCMC’s Binh Chanh district, Binh Duong province, and Dong Nai province.

New land banks for residential development will soon be available as HCMC aims to build 11 TOD compact urban areas and auction 22 land plots around metro stations. For developers, rising capital costs create a new “puzzle” where securing the land plots and balancing costs, prices, and product segmentation are critical to ensuring liquidity and operational efficiency.

New opportunities arising in industrial real estate

The industrial real estate segment remained the market’s top performer in 2024, with rising rents, growing supply, and high occupancy rates. This growth was primarily driven by FDI in manufacturing, fueled by supply chain diversification and the China+1 strategy.

In major and tier-1 markets, industrial land rents increased by 2-5% per quarter. New supply was expected to increase as numerous industrial park projects received licenses or began construction nationwide. Industrial and logistics (I&L) properties continued to attract significant interest from foreign investors, leading real estate transactions in Vietnam throughout 2024.

In the short term, the economic, trade, and geopolitical fluctuations associated with Donald Trump’s new policies may temporarily affect foreign investment and exports. However, due to its strategic location, relative political stability, competitive costs, and improving investment environments, Vietnam still has potential to become the next global manufacturing hub if seizing this opportunity.

Demand is expected to grow in these types of industrial property: